With just 1:30 left on the clock in the 2002 Super Bowl, the New England Patriots were locked in a 17-17 tie against the powerhouse St. Louis Rams. The pressure was immense as Tom Brady, a relatively unknown quarterback at the time, took the field on his own 17-yard line with no timeouts remaining. Displaying immense resilience, Brady navigated the offense efficiently down the field while simultaneously managing the clock carefully, culminating in an opportunity for kicker Adam Vinatieri to kick a 48-yard field goal through the uprights to seal the W in a thrilling ending as time expired.

Tom Brady's brilliance isn't that he suddenly received inspiration to know how to lead an offense in those final 90 seconds on the biggest stage in sports. His brilliance instead is on how much work and focus he put into designing and practicing their 2 minute playbook before the season started and again before each and every game.

You might be wondering how does football tie back to business.

The Economic Cycle

In some ways, the 60 minutes of a football game resembles the various stages of the economy. There are ups and downs, and external pressures that might put your company in a situation that you'd rather it not be in. Nevertheless you might find your company in that position, and so the next best thing is to prepare your team to win by creating and practicing a playbook that outlines the strategy and specific calls you will make, and lead your team to victory just like one of the most decorated team captains in sports.

As a business leader, you probably plan to run your business for a long time, in which it is likely to experience the full lifecycle of an economic cycle, which includes periods of good times (expansions) and periods of bad times (contractions or recessions).

Your curiosity may naturally try to figure out what part of the economic cycle we're in right now. After all, the Fed just decreased rates by 0.50% in response to unemployment increasing to 4.2% in August 2024, up from a healthy 3.4% we experienced in 2022. Jamie Dimon at JP Morgan recently made a prediction that we'll begin to see more economic deceleration in 2025 and on top of it all, economists agree that the global economy has been in the late-stage of the business cycle for the better of the last two years. Lower interest rates could take some of the pressure off, but the Fed may just be trying to play catch up after leaving rates high for too long, and it may already be too late.

We don't know for sure where we are and when the next recession might be, and trying to make any accurate predictions is a fool's errand.

What is important is that you do have a plan for when it does happen, so your company can thrive through it all. While less intuitive, the same is true for why you would want a playbook to build the strategy to thrive through a period of rapid expansion.

The TAP Framework

While it may seem intimidating at first, creating a cycle playbook is as simple as following 3 steps, outlined in the TAP framework below:

- Test: Stress test the resilience of your company on your key performance metrics that affect profitability

- Address: Take steps to currently address existing vulnerabilities

- Playbook: Map out tactical strategies using the stop/start/continue framework to navigate through a change in the current business cycle

- Stop: what do we stop doing

- Start: what do we start doing

- Continue: what do we continue doing

We'll follow these steps to create a sample playbook using an example with a fictitious company, LaunchMinds, a marketing agency that helps clients with running their digital marketing strategies.

Test

Businesses exist to create a profit, and you'll want to have a good sense of what your key performance metrics look like that drive that profit. These key performance metrics will look differently in each industry, but what they all have in common is the following components:

- How easy is it to make a sale

- How many sales you make

- How frequently existing customers come back for your product

- How much value you get from each sale or contract

- How much costs are relative to sales

Do you need help with identifying and measuring the right key performance metrics for your company? Before you hire a consultant, we recommend setting up your own data infrastructure. Read our full guide for a breakdown on the costs to implement data infrastructure for companies of various sizes.

For LaunchMinds, their key performance metrics might include the following:

Cost per Acquisition (CAC): $15,000

The total cost, including marketing and sales costs, to acquire a single customer. Since professional services companies are consultants who take fewer and higher value clients, it is not too surprising for a company like LaunchMinds to spend as much as $15,000 to acquire a customer.

Acquisition Cost Payback: 3 months

The duration it takes for a new client acquisition to pay back the total costs of acquiring that customer. If LaunchMinds spent $15,000 to acquire a customer that adds $10,000 revenue per month with a 50% margin, then it would take 3 months for that customer to payoff the total costs of acquiring that customer.

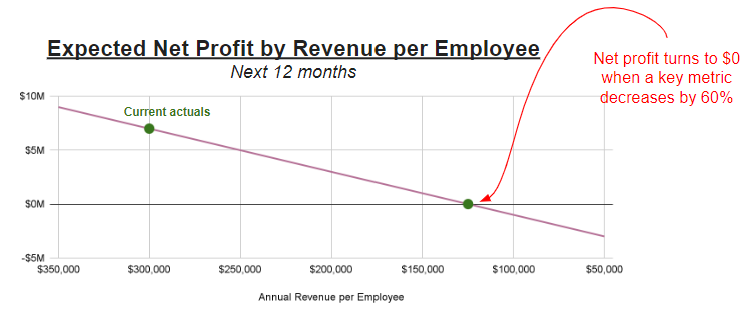

Annual Profit per Employee: $300,000

Total annual profit divided by the number of employees working at the firm. This represents the value that each employee adds to the business.

Now lets stress test the company. The exercise of "stress testing" is to stress components of the aforementioned key metrics to see at what point company profit falls to its breakeven point. We'll start with two immediate observations of how LaunchMinds could go from a profitable to unprofitable business in a short period of time:

First, their acquisition costs are very high, such that they do not breakeven until 3 months after acquiring a new customer. If the customer stays with the firm for 12 months, then 9 months are adding value. If the average duration of a client gets cut in half to just 6 months, then the profit added from that client would decrease by 67%! If the average duration of a client falls to 3 months, then LaunchMinds would not make a profit at all. In other words, LaunchMinds is resilient to a decrease in duration of a customer up to 75%.

Secondly, the annual profit per employee is quite strong at $300,000. If the company experiences customers churning and a tougher time acquiring newer customers, this number could gets dangerously close to the breakeven point as well. If we plotted LaunchMinds profit per employee by decreases in client acquisition, we would see that Launchminds would become unprofitable if the total number of clients drop by 60%.

Address

Once you've identified your key metrics and stressed them to the point of breakeven profitability, you will have a better idea of what needs to be done today to increase your resilience to external stressors. In general, you'd like to button up the business to reduce exposure to the biggest points of failure, and diversify on your key vulnerabilities.

Narrow Your Focus

"People think focus means saying yes to the thing you've got to focus on. But that's not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully. I'm actually as proud of the things we haven't done as the things I have done. Innovation is saying no to 1,000 things."

Steve Jobs

By focusing on what your company does exceptionally well, and saying no to the other good ideas, you are able to create an extremely compelling value proposition to your customers externally, and can create an extremely efficient operation internally. Ask your best 2-3 customers why they chose to work with you. If they say "you're the most reputable marketing agency serving the manufacturing industry in the southeast," then you can get a pretty good sense on what they want you to continue focusing on-- manufacturing and the southeast. It might be a good idea to decline the temptation to expand to a different industry or geography unless you've already captured the majority of the market share in those segments of the market.

Tighten Up Financials

Working Capital is the amount of money you have in your cash balance today, and excludes how much you expect to get paid tomorrow from an Account. Contracts with your clients may offer a payment plan that allows the client to pay after work has been done. This constitutes your Account Receivables in accounting. This is money that you might not ever actually see, in the scenario where a client runs out of money or goes bankrupt before they can pay you back in a scenario of widespread financial distress in the economy.

Work with your CPA to do an audit of your existing contracts and your financial KPIs (key performance indicators) like Weekly Net Cash Flow and Current Ratio. Make an assessment of the impact to your own company's solvency if you had to charge off your 2-3 largest accounts.

If this scenario looks bleak, you have a few options to optimize your working capital:

- Update terms on contracts with new and existing clients that require smaller, more frequent payments and a shorter borrowing terms

- Renegotiate terms with suppliers to extend payment terms on orders, or shop around for new suppliers who offer more lenient terms

- Reduce spend on R&D that isn't expected to generate revenue in the next 6-12 months

At the end of the day, the most important thing is to look at the numbers and address anything that surprises you (disclaimer: you will most certainly find a few surprises, including wasteful expenses you did not approve). Work with your FP&A team to do a deep dive to find more ways to increase your working capital.

Diversify on Key Vulnerabilities

Don't put all your eggs in one basket, as the saying goes. In your business, this can be represented in a few ways:

- Does more than 50% of your revenue come from 5 or fewer major clients?

- Do you rely on a single supplier to provide all your parts?

- If a competitor were to offer a better product or service at half the cost, would you be able to break into alternative products or services to continue generating revenue?

For the first two questions, diversification is quite simple-- don't get too comfortable with a business that relies on a few good clients and a few good suppliers. Make it a priority to acquire more larger clients and negotiate multiple suppliers. When it comes to the last question, however, there is a fine balance to walk between focus and diversification.

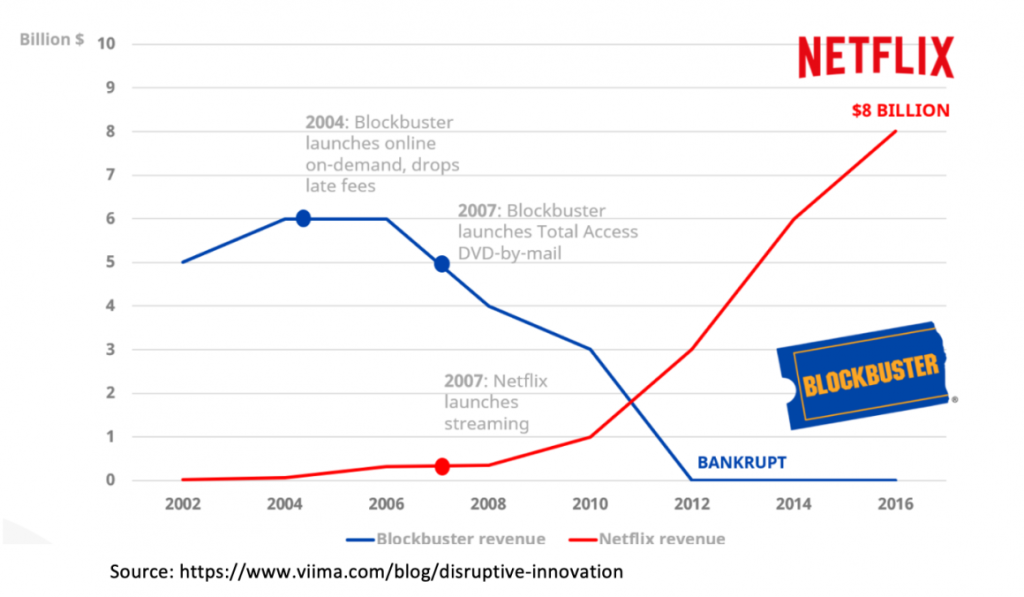

Focusing on one product allows you to be exceptional at delivering value efficiently to customers. But it only works until it doesn't. Never forget the iconic example of Blockbuster. I remember walking the aisles with my siblings on a Friday afternoon in the early 2000's, picking out a movie and snacks for family night, and we loved it despite the price and the inconvenience. Believe it or not, the leaders at Blockbuster turned down a chance to purchase Netflix for $50 million in 2000. We all know what happens next--Netflix leaned into modern technologies while Blockbuster simply kept doing what used to work well for them, and now our family night experience is convenient, inexpensive, and ridden of late fees, and Blockbuster simply does not exist. They went from generating $6 billion annual revenue in 2004 to filing for bankruptcy 8 years later, and Netflix continued to grow to $36 billion annual revenue in 2024.

I recommend re-evaluating your business strategy every 6-12 months. Assess what is going well and genuinely listen to your customers' complaints about what they dislike about your product or service. If customers are leaving to a competitor, give them a call to understand why. Work with the team to identify how you could make your offering even better. Lean into incremental improvements that make sense to incorporate to be continue being a dominant leader in your space.

Playbook

Once you have stress tested your KPIs and addressed (or created a plan to address) the biggest points of failure in your business, you now have the full context to build your playbook. Don't feel the need to do this all alone. Often times you'll receive the most value from frontline employees who have a deep understanding of the specific vulnerabilities your company is experiencing, and equipped with the right tools, they can help you solve these challenges for you.

Determine what you will stop, start and continue doing in response to a change in the economic environment, namely at the start of a contraction period as well at the start of an expansion period.

For example, at the start of a contraction period, LaunchMinds would respond by 1) stop spending on long-term investments on market research that isn't expected to generate revenue for 18 months, 2) start offering a loyalty program with discounts to existing customers, as well as expanding referral bonuses, and 3) continue focusing on its core marketing service to their specific industry and geography.

Get started with applying the TAP framework and building your business resilience playbook.

Need a jumpstart? Get access to our free template using the form below!

Table of Contents